BiPRO e.V.

BiPRO e. V. (Business Institute for Process Optimisation; German: Brancheninstitut für Prozessoptimierung) is a non-profit association which aims to improve business and information processes by the development and implementation of standards in the area of financial services, especially in the German and Austrian insurance sector.

For more information:

If you have any further questions about BiPRO and our work do not hesitate to contact us.

E-Mail: marketing@bipro.net

Association

The association was founded in 2006, is located in the greater area of Düsseldorf and has over 300 member companies. There are four main categories of members: insurance companies, insurance intermediaries, consulting companies and software manufacturers. Please click the button below to view the full list of our members (in German language).

BiPRO enables its members to discuss news and market developments and to work on projects to develop and improve digital standards for the insurance sector. The standards development is conducted in several committees which differ in their tasks and type of projects using standards technology.

Currently open insurance, open finance as well as FIDA (Financial Data Access Regulation) have become a high priority topic in the association’s activities due to political regulations within the European Union.

Standards

BiPRO has introduced two main standards technologies which are the basis for standardised interfaces between the software systems of the stakeholders in the insurance market. This affects different release generations.

RClassic

BiPRO standards in RClassic technology are based on SOAP and XML. RClassic standards are used by most insurance companies and intermediaries for a broad range of processes – including quotation, offer, new business application, transfer of policy documents and contract data, change of contract, contract information, transfer of broker mandates and accounting information, as well as claims notification and claims status information. These standards support all private and commercial lines of business in life, health and property & casualty insurance.

Even though there are no new standards developments in this technology, the association is still maintaining RClassic. This includes change requests, e.g. changes required by new laws or regulations and minor improvements.

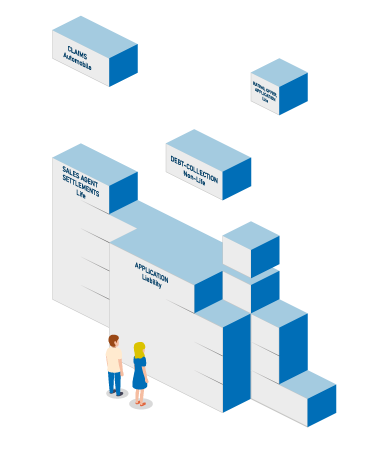

RNext

BiPRO RNext is the code name of the next release generation of BiPRO standards. RNext follows the technological evolution of SOAP to JSON/REST and microservices. Furthermore, it relies on modern specialist design principles such as Domain Driven Design and Event Storming as well as on more agile working methods, which are following the principles of open source development.

RNext is accelerated by active community members of the BiPRO association to enable a participation in the API economy. The BiPRO community essentially aspires to support the digital sovereignty of insurance. The opportunity of a digital network with the pace and quality necessary is a significant factor of success for the insurance industry, because it enables the participation in the formation of a technological and social change. Therefore, RNext is a significant step for future economic success considering the digital transformation.

RNext standards are developed in so-called RNext Groups, formed by interested stakeholders for a specific domain. RNext Groups are currently active in contract processes, claims processes and private as well as occupational pension insurance.